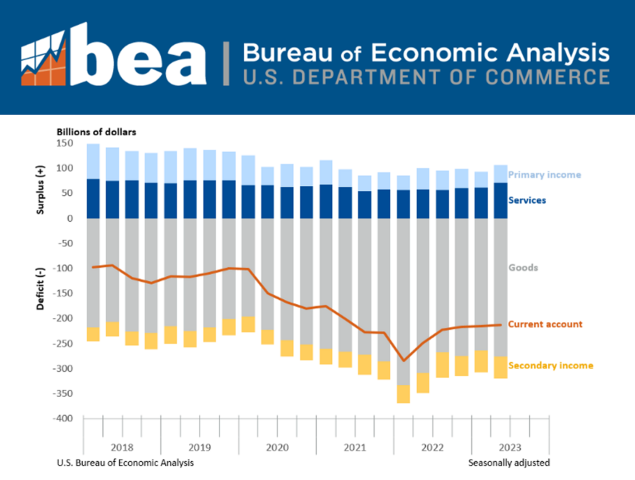

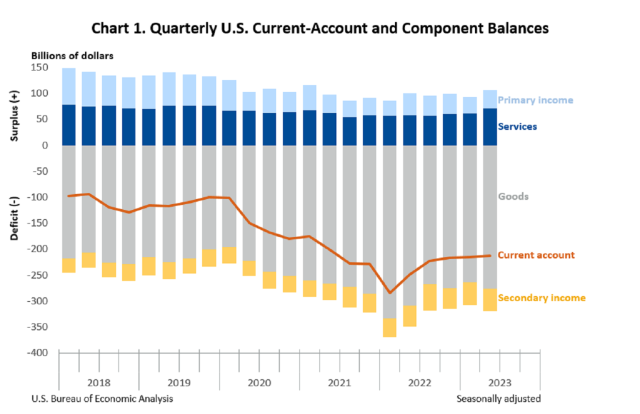

UNITED STATES: The US Bureau of Economic Analysis (BEA) has released statistics showing that the country’s current account deficit narrowed by 1.1% to $212.1 billion in the second quarter of 2023. This figure reflects the combined balances on trade in goods and services and income flows between US residents and residents of other countries. The revised first-quarter deficit was $214.5 billion. The second-quarter deficit was 3.2% of current-dollar gross domestic product, up less than 0.1% from the first quarter.

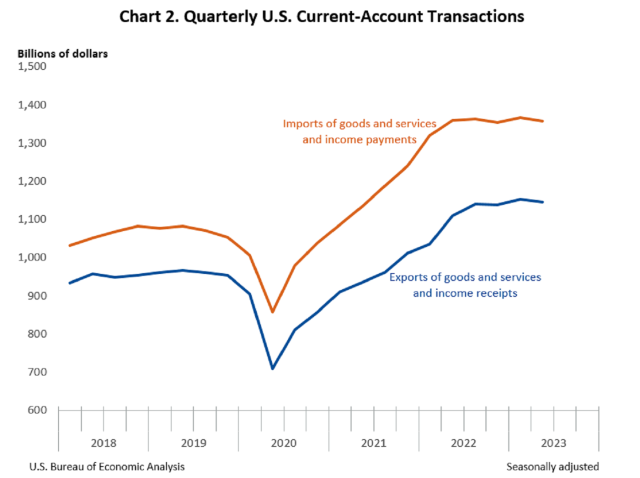

The narrowing of the current account deficit in the second quarter was primarily due to expanded surpluses on services and on primary income that were mostly offset by an expanded deficit on goods. Exports of goods and services to, and income received from, foreign residents decreased $7.8 billion to $1.15 trillion in the second quarter. Imports of goods and services from, and income paid to, foreign residents decreased $10.2 billion to $1.36 trillion.

Exports of goods decreased $29.0 billion to $497.6 billion, and imports of goods decreased $17.1 billion to $772.8 billion. The decreases in both exports and imports mostly reflected a decrease in industrial supplies and materials, primarily petroleum and products.

Receipts of primary income increased $15.5 billion to $354.5 billion, and payments of primary income increased $12.0 billion to $319.5 billion. The increases in both receipts and payments reflected increases in nearly all major components, led by other investment income. The increase in other investment income, primarily interest on loans and deposits, was mainly due to higher short-term interest rates amid the tightening of US and foreign monetary policy.

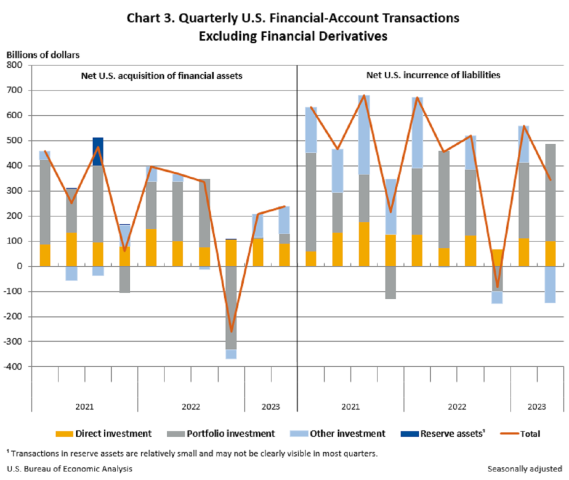

Net financial account transactions were $109.0 billion in the second quarter, reflecting net US borrowing from foreign residents. Second-quarter transactions increased US residents’ foreign financial assets by $238.2 billion. Transactions increased other investment assets, mostly loans, by $109.2 billion; direct investment assets, mostly equity, by $88.4 billion; portfolio investment assets, mostly equity, by $40.3 billion; and reserve assets by $0.3 billion.

The US current account deficit has been a topic of concern for some time, with critics arguing that it reflects a lack of competitiveness in the country’s economy. However, the narrowing of the deficit in the second quarter is a positive sign, indicating that the US is making progress in addressing this issue. The BEA’s statistics provide valuable insights into the state of the US economy and its interactions with the rest of the world and will be closely watched by economists and policymakers alike.