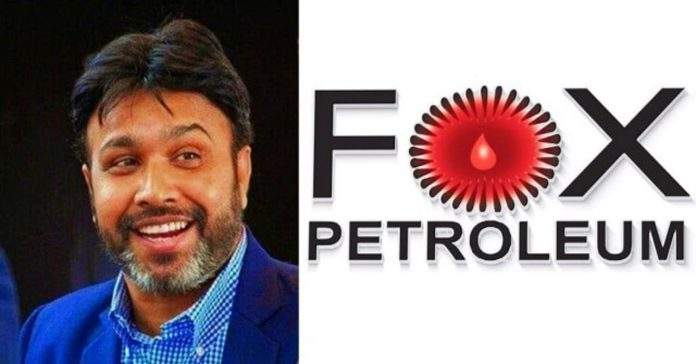

By: Dr. Ajay Kumar, PhD, Chairman & Managing Director of Fox Petroleum Group

On 1 February 2026, Finance Minister Nirmala Sitharaman presented India’s Union Budget for 2026–27 — her record ninth consecutive budget. Once again, the nation got a mix of glittering headlines, subtle disappointments, and numbers that sound big because… well… they are big.

What’s Good (Or At Least Sounds Good)

1. Record Infrastructure Spending

The government has pushed infrastructure expenditure to an all-time high of ₹12.2 lakh crore, up about 8.8% over last year. In human terms: more roads, bridges, ports — essentially more concrete for our grandchildren to stumble over. Analysts believe this could boost jobs and growth if the projects actually get done.

2. Boost to Growth Outlook

Macroeconomic projections suggest real GDP growth in the ~6.8%–7.2% range for FY27 — solid by global standards, and still better than many peers. Science says steady growth isn’t just a one-year miracle; it’s the product of sustained investment and productivity.

3. Tax System Simplification

A new Income-Tax Bill 2025 aims to cut through the legal jungle — reducing sections by almost 35% and removing confusing provisos. If this actually makes compliance easier, it’s a win for taxpayers and accountants (mostly accountants, but taxpayers will feel it too).

4. Expansion of Social and Tech Infrastructure

Programs for agriculture (₹1.7 lakh crore), urban development funds, more labs in schools, broadband in health centres, and even a National AI Centre of Excellence are part of this mix. This is budget-speak for “we’re trying to be future-ready.”

What’s Not So Great (Brace Yourself)

1. Fiscal Deficit Still Stubborn

Even though the government claims prudence, the fiscal deficit remains high — roughly 4.3% of GDP. That’s like saying “I’m saving, honest,” while maxing out the credit card. More borrowing also means future citizens get to pay the bill.

2. Household Reality vs Macro Numbers

The macro data looks okay, but many households feel inflation in the grocery queue long before statisticians finish publishing. A scientific forecast can show GDP growth of ~7%, but if food inflation is ~8–9%, real relief doesn’t come home.

3. Tax Relief Expectations — Still Limited

Middle-class taxpayers were hoping for sharper tax cuts or incentives. But this budget’s tax benefits feel… underseasoned. Relief was there, but it wasn’t the feast most people were hungry for. No major overhaul in slabs or long-term capital gains tax sweeteners made headlines.

4. Private Investment Still Waiting for a Signal

Scientific analysis of revenue growth shows that tax buoyancy is lower than expected — meaning tax revenues aren’t keeping up with GDP growth as hoped. This leaves less runway for spending without borrowing. It’s like running a marathon and forgetting your water bottle halfway.

The Sarcastic Summary

If this budget were a Bollywood movie, it’d be “Dilwale Dou Saal Baad; Same Masala” — we’ve seen similar twists (higher capex!), occasional drama (high deficit!), and some new characters (AI centre here, agriculture support there). But the plot twist — genuine relief for everyday people — remains subtle, like a background track you barely notice.

Scientific Data Speaks (Without Jargon)

| Indicator | Figure / Trend |

| Infrastructure Spend | ₹12.2 lakh crore (record) |

| Expected GDP Growth | ~6.8–7.2% |

| Fiscal Deficit Target | ~4.3% of GDP |

| Simplified Tax Sections | Reduced to 536 from 819 |

This is budget science, not astrology — you can measure it, debate it, and yes, budget analysts do fight over charts like it’s the IPL of economics.

Conclusions: Who Wins, Who Shrugs, Who Loses?

👉 Market: Likely impressed by record capex and growth forecasts. Infrastructure and industrial stocks listen here.

👉 Gen Z: Notices AI funding and tech vision, but will grumble about job prospects if employment doesn’t soar.

👉 Common Citizen: Feels moderate relief — essential services and rural push help, but pockets aren’t yet bursting.

👉 Economists: Will have strong opinions — some praise growth focus, others warn the deficit is like a mosquito in a monsoon: small but irritating.

Final verdict: This budget is ambitious in goals, safe in promise, and conservative in immediate relief. It nudges growth and investment — but doesn’t deliver dramatic fireworks for taxpayers. The economy gets a roadmap; citizens get a gentle reminder that patience is a budgetary virtue.

About: Dr. Ajay Kumar, PhD, is an Indian entrepreneur, strategist, and global business leader, currently serving as Chairman & Managing Director of Fox Petroleum Group. With a background spanning energy, infrastructure, media, IT, and aerospace, he is known for steering large cross-border projects and institutional partnerships. Dr. Kumar has been involved in international energy negotiations, strategic investments, and infrastructure planning across Asia, the Middle East, Europe, North America, and Africa. Blending academic rigor with practical leadership, he is recognized for his insights on energy security, investment policy, and emerging technologies, and is a regular contributor to discussions on economic strategy and global markets.