(An Open-Ended Index Fund tracking the Nifty Bank TRI)

MUMBAI: In a significant move to tap into the dynamic growth of the Indian banking sector, Axis Mutual Fund is excited to announce the New Fund Offer (NFO) of the ‘Axis Nifty Bank Index Fund’. This open-ended index fund aims to track the Nifty Bank TRI, providing investors with a mechanism to participate directly in the growth narrative of leading Indian banks.

“India’s economic rise is a compelling narrative driven by several factors. If addressed effectively, our growth story has the potential to propel the nation toward becoming a major global economic power. Against this backdrop, India’s banking sector continues to exhibit growth and resilience,” remarked B. Gopkumar, MD & CEO, Axis AMC. “Fuelled by robust regulatory frameworks and the rapid adoption of digital banking, the sector is well-positioned for sustained expansion. The Axis Nifty Bank Index Fund offers investors a strategic opportunity to tap into this growth opportunity. The sector benefits from a strong emphasis on innovation and adherence to the highest governance standards, thereby capitalizing on the transformative trends reshaping India’s banking landscape.”

Managed by Mr. Karthik Kumar and Mr. Ashish Naik, the fund aims to provide returns before expenses that correspond to the total returns of the Nifty Bank TRI, subject to tracking errors. However, there is no assurance that the investment objective of the scheme will be achieved.

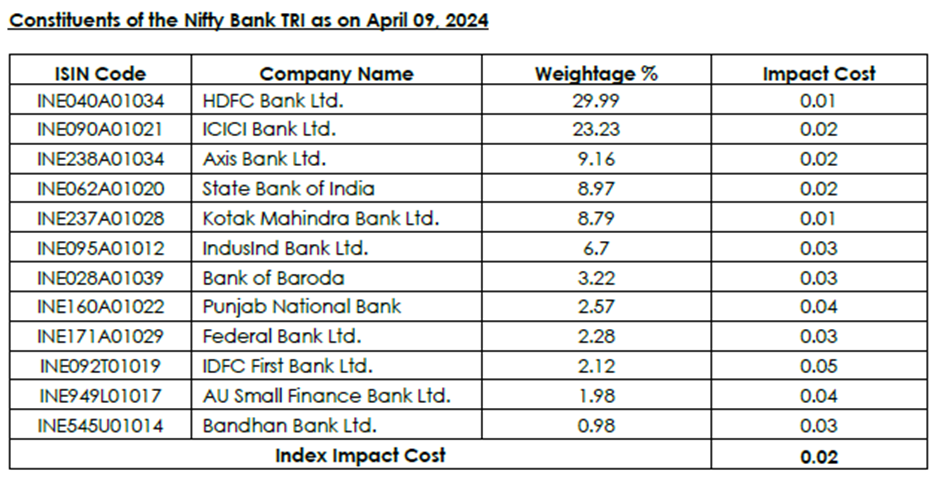

The index comprises some of the largest and most liquid banking stocks in India, representing a crucial segment of the national economy.

“This fund is an interesting opportunity for investors to gain exposure to the banking sector, which is expected to play a pivotal role in India’s economic expansion,” explained Ashish Gupta, Chief Investment Officer at Axis AMC. “With increasing financial inclusion and a shift towards more sophisticated banking services, the sector can offer the potential for significant returns.”

The Axis Nifty Bank Index Fund

The Scheme would invest in stocks comprising the underlying index and shall track the benchmark index. The Scheme may also invest in debt and money market instruments, in compliance with Regulations to meet liquidity and expense requirements. The Scheme shall invest in stocks forming part of the underlying Index in the same ratio as per the index to the extent possible and to that extent follow a passive investment strategy, except to the extent of meeting liquidity and expense requirements. Essentially, the fund employs a passive investment strategy designed to mirror the performance & constituents of the Nifty Bank TRI. Further, the index undergoes rebalancing on a semi-annual basis to ensure it reflects the current landscape of the sector by including the companies that best represent its performance.

The Axis Nifty Bank Index Fund can be a potentially attractive option for investors seeking to capitalize on the sector’s growth by including a diversified mix of Large-Cap and Mid-Cap banking companies (PSUs as well as Private Banks). “The Axis Nifty Bank Index Fund offers a cost-effective and efficient way to gain exposure to the Indian banking sector and we invite investors to seize this opportunity,” concluded Mr. Gopkumar.

The NFO will open for subscriptions on May 3, 2024, and will close on May 17, 2024.

For detailed information on the investment strategy and to view the Scheme Information Document (SID)/Key Information Memorandum (KIM), please visit www.axismf.com.

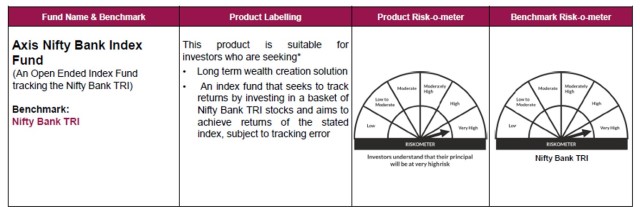

Product Labelling and Riskometer: Axis Nifty Bank Index Fund (an open-ended index fund tracking the Nifty Bank TRI)

*Investors should consult their financial advisors if in doubt about whether the fund is suitable for them

(The product labeling assigned during the New Fund Offer is based on an internal assessment of the Scheme Characteristics or model portfolio and the same may vary post NFO when actual investments are made.)