- An Open-ended equity scheme following a value-investing strategy

- The scheme opens on 7th February 2025, closes on 21st February 2025, and reopens for continuous sale and repurchase from 5th March 2025

MUMBAI: Mahindra Manulife Mutual Fund, a joint venture between Mahindra & Mahindra Financial Services Limited (“Mahindra Finance”) and Manulife Investment Management (Singapore) Pte. Ltd., has introduced the Mahindra Manulife Value Fund, an open-ended equity scheme designed for investors seeking long-term growth through a value investing approach. The fund aims to identify and invest in fundamentally strong yet undervalued companies, unlocking their potential for sustainable returns.

The Mahindra Manulife Value Fund aims to generate long-term capital appreciation by investing in a diversified portfolio of equity and equity-related instruments of fundamentally strong yet undervalued companies. The fund follows an active investment strategy, identifying stocks trading below their intrinsic value with high turnaround potential. Capitalizing on potential stock re-rating and earnings growth, it offers investors a compelling opportunity to build wealth over time.

Anthony Heredia, MD & CEO of Mahindra Manulife Mutual Fund, emphasized the relevance of this offering, stating, “Value investing has long been a time-tested strategy for sustainable wealth creation. With this fund, we aim to identify fundamentally strong businesses available at attractive valuations, providing investors with a structured approach to unlocking long-term growth potential. This offering is well-suited for those looking to build a resilient core portfolio while capitalizing on market opportunities.”

Mahindra Manulife Value Fund will be managed by Krishna Sanghavi, Chief Investment Officer – Equity, who brings over 30 years of experience in the Indian equity markets, along with Vishal Jajoo, Fund Manager – Equity.

Krishna Sanghavi outlined the fund’s core objective: “Our approach integrates fundamental research with valuation-based stock selection. The goal is to build a well-diversified portfolio by identifying undervalued businesses with strong financials, sustainable competitive advantages, and robust growth potential. The fund follows a disciplined investment framework to maximize risk-adjusted returns over the long term.”

The investment approach of the Mahindra Manulife Value Fund combines bottom-up stock selection with a focus on companies trading below their historical valuation multiples. The fund will actively manage portfolio allocation across market capitalizations, leveraging fundamental analysis to uncover quality businesses with strong cash flows and management efficiency. By following a structured value investment process, the fund aims to unlock potential in sectors and companies poised for long-term growth.

The Mahindra Manulife Value Fund is ideal for investors seeking to invest in fundamentally sound yet undervalued stocks. The New Fund Offer (NFO) opens on 7th February 2025, with the subscription window closing on 21st February 2025. The fund will subsequently reopen for continuous sale and repurchase from 5th March 2025.

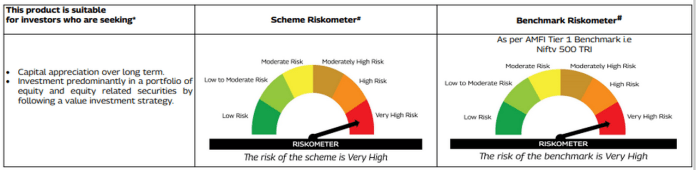

** The product labeling/risk level assigned for the Scheme during the New Fund Offer is based on an internal assessment of the Scheme’s characteristics or model portfolio and the same may vary in the New Fund Offer when the actual investments are made.

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.

Disclaimer:

The views expressed here in this document are for general information and reading purposes only and do not constitute any guidelines and recommendations on any course of action to be followed by the user. No representation or warranty is made as to the accuracy, completeness, or fairness of the information and opinions contained herein. The views are not meant to serve as a professional guide/investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product instrument or mutual fund units for the user. This note has been prepared based on publicly available information, internally developed data and other sources believed to be reliable. While utmost care has been exercised while preparing this presentation, Mahindra Manulife Investment Management Private Limited (MMIMPL) does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses, and damages arising out of the use of this information. The data/statistics, wherever provided, are given to explain general market trends in the securities market, it should not be construed as any research report/research recommendation. Users of this presentation should rely on information/data arising out of their investigations and are advised to seek independent professional advice and arrive at an informed decision before making any investments. Neither Mahindra Manulife Mutual Fund, MMIMPL nor Mahindra Manulife Trustee Private Limited, its directors or associates shall be liable for any damages that may arise from the use of the information contained herein.

For detailed asset allocation, investment strategy, scheme-specific risk factors, and more details, please read the Scheme Information Document and Key Information Memorandum of Mahindra Manulife Value Fund available at ISCs of MMIMPL and Computer Age Management Services Limited and also available on www.mahindramanulife.com.

Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments.

The information contained herein is not for distribution and does not constitute an offer to buy or sell or solicitation of an offer to buy or sell any schemes/Units of Mahindra Manulife Mutual Fund/securities in the United States of America (‘US’) and/or Canada or for the benefit of US Persons (being persons falling within the definition of the term “US Person” under the US Securities Act of 1933 or as defined by the U.S. Commodity Futures Trading Commission, as amended) or residents of Canada as defined under applicable laws of Canada.

Mutual fund investments are subject to market risks, read all scheme-related documents carefully