- Sales increase to €9.23 billion in 2023 (2022: €9.07 billion), company forecast: €9.2 to €9.7 billion

- Adjusted EBIT margin of 3.7 percent (2022: 2.5 percent), came in higher than the company’s own guidance range of 2.9 percent to 3.4 percent

- Free cash flow of €84.9 million (2022: €123.2 million) above the company’s expectations of approximately €50 million

- Growth in electrification sales of around 20 percent to €1.3 billion (2022: €1.1 billion)

- Total order intake of more than €12 billion, including around €8.3 billion in the electrification business

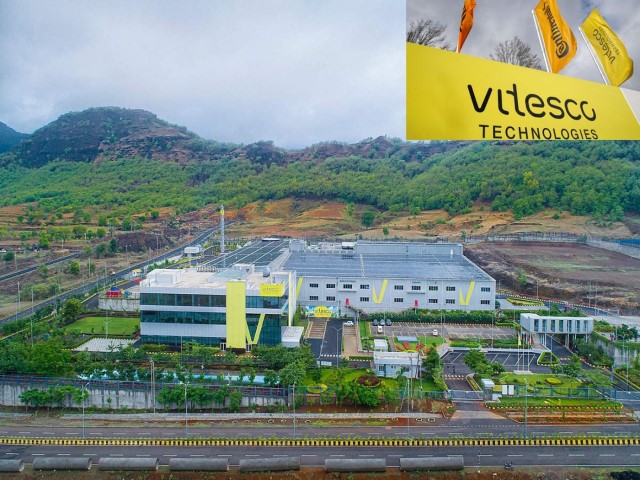

PUNE: Vitesco Technologies, a leading international provider of modern drive technologies and electrification solutions for sustainable mobility, is today publishing its preliminary results for fiscal year 2023.

CEO Andreas Wolf is satisfied with the results: “Despite global challenges, 2023 was a successful year and provides a solid basis for the upcoming years.”

Profitability and cash flow exceed the company’s expectations

In 2023, Vitesco Technologies increased its consolidated sales to €9.23 billion despite a persistently challenging market environment (2022: €9.07 billion; market consensus: €9.34 billion).

The sales guidance published by the company included a range of €9.2 billion to €9.7 billion. Adjusted for changes in the scope of consolidation and exchange rate effects, sales increased by 4.4 percent. Vitesco Technologies’ core business achieved organic growth of 12.2 percent, compared to the general growth in automotive production of 9.4 percent.

Vitesco Technologies generated sales of around €1.3 billion from electrification components in 2023 (2022: €1.1 billion). The reason for the less significant increase in sales was the softening of demand for electrification components in the market in the fourth quarter of 2023. The numerous project ramp-ups could not compensate for this effect.

Adjusted EBIT amounted to €341.1 million (2022: €225.5 million; market consensus: €307 million). Due to the further improved operating performance, the company’s adjusted EBIT margin of 3.7 percent (2022: 2.5 percent) was much higher than its guided range of 2.9 percent to 3.4 percent and also exceeded expectations (market consensus: 3.3 percent).

Thanks to improved profitability and despite the negative financial impact from the contract manufacturing business, free cash flow amounted to €84.9 million in 2023 (2022: €123.2 million). This was higher than Vitesco Technologies’ forecast of approximately €50 million and the market consensus of €71 million.

Free cash flow included a cash outflow of €499.8 million (2022: €446.6 million) for capital expenditures on property, plant, equipment, and software (excluding right-of-use assets under IFRS 16). The ratio of capital expenditures to sales was therefore 5.4 percent (2022: 4.9 percent).

Vitesco Technologies’ total order intake in 2023 amounted to more than €12 billion (2022: €14 billion). Roughly €8.3 billion were attributable to electrification components (2022: €10.4 billion).

“Thanks to an order backlog of well over €30 billion in the electrification business, we are off to a strong start and are well-positioned for the future. The high level of order intake in recent years reaffirms that we are a preferred supplier in the electromobility sector”, says CEO Andreas Wolf.

With an equity ratio of 37.6 percent as of December 31, 2023 (December 31, 2022: 40.3 percent), Vitesco Technologies’ balance sheet remains exceptionally solid. The company reported net liquidity of €337.0 million as of December 31, 2023 (December 31, 2022: €333.4 million).

CFO Sabine Nitzsche is more than satisfied with the results, given that the company is still on a path of transformation and the market environment remained challenging in 2023: “Despite extensive transformation activities, we achieved further increases in company sales and adjusted EBIT. We fully achieved – and in some cases exceeded – our published guidance for all the main financial KPIs.”

Vitesco Technologies will publish a comprehensive overview of the Group’s performance in 2023 as well as an outlook for fiscal year 2024 at the Annual Press Conference on March 14, 2024.