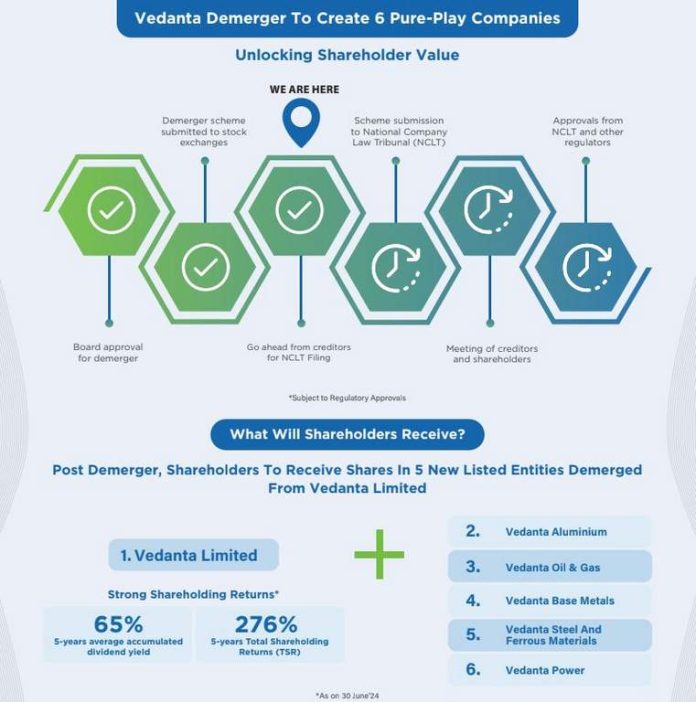

MUMBAI: Vedanta Limited (“Vedanta”), one of the world’s leading critical minerals, energy, and technology companies, announced that it has received a go-ahead from 75% of its secured creditors for obtaining clearance from the stock exchange(s) and subsequently filing its demerger scheme with the National Company Law Tribunal (NCLT) for its proposed demerger.

As an organization dedicated to supporting the dream of an Atmanirbhar Bharat in natural resources, Vedanta’s demerger will create sector-focused entities, aligned with India’s global leadership goals in critical minerals, energy security as well as renewables and technology sectors. The demerger will help in simplifying Vedanta’s corporate structure by creating independent businesses and will offer global investors direct investment opportunities in pure-play companies linked to India’s impressive growth.

Earlier this month, at Vedanta’s Annual General Meeting, Anil Agarwal, Chairman, Vedanta Ltd. had said, “Demerger of our businesses will lead to the creation of 6 strong companies, each a Vedanta in its own right. This will unlock massive value. Each demerged entity will chart its course but will follow Vedanta’s core values, its enterprising spirit, and global leadership.”

Vedanta’s existing businesses will be structured in the following six independent companies after the demerger:

- Vedanta Aluminium

- Vedanta Oil & Gas

- Vedanta Power

- Vedanta Steel and Ferrous Materials

- Vedanta Base Metals

- Vedanta Limited

The demerger is planned to be a simple vertical split, for every 1 share of Vedanta Limited, the shareholders will additionally receive 1 share of each of the 5 newly listed companies.

Vedanta has a track record of giving strong returns to its shareholders. As of 30 June’24, Vedanta’s total shareholder return over 5 years stood at 276%, while the 5-year average accumulated dividend yield at 65%, delivering significant value for shareholders.

Currently, Vedanta is the Indian subcontinent’s only diversified natural resources company. It has invested over $35 billion in India and is making rapid expansion efforts through 50 strategic growth projects. Vedanta has a unique portfolio of assets among Indian and global companies. It is the sole producer of zinc and silver in India – and amongst the largest in the world. It is India’s largest producer of aluminum and largest private sector producer of oil, along with being one of India’s largest generators of power and purchasers of renewable energy. Also the sole producer of Nickel in India, Vedanta houses various key metals and minerals in its portfolio including chromium, copper, and a traditional ferrous vertical including iron ore and steel.