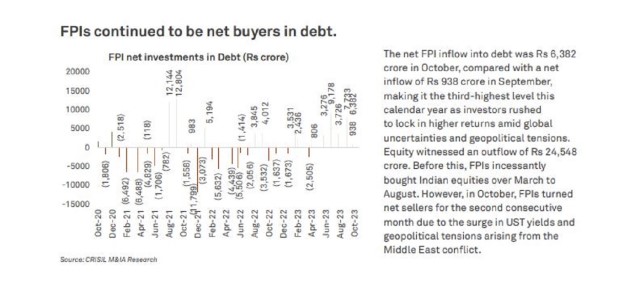

INDIA: CRISIL, an S&P Global Company, has released its November 2023 outlook on interest rates. The report covers factors influencing the outlook, including the yield on the new 10-year benchmark government security, US treasury yields, and crude oil prices. The report also includes analytical contacts as well as information on CRISIL’s data and analytics platforms, ESG scores, company reports, and SME gradings.

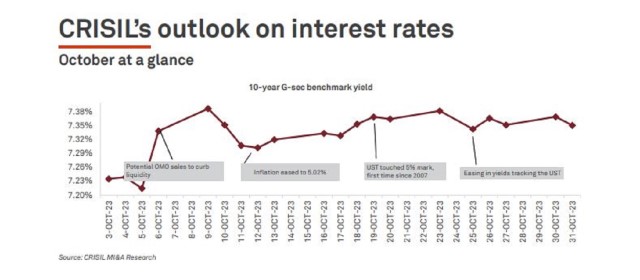

According to the report, the yield on the new 10-year benchmark government security (G-sec;7.18% GS 2033) opened October at 7.23% and closed at 7.35%, up 14 bps from its September closing of 7.21% and outside CRISIL’s forecast range of 7.23-7.33%. In the first week, bonds traded largely with a negative bias due to a surge in US Treasury (UST) yields and crude oil prices. In addition, the Reserve Bank of India (RBI) hinted at open market operations (OMO) sales in the future to manage liquidity in the market. This led the yield on the 10-year benchmark G-sec to harden by 14-15 bps. The domestic 10-year benchmark yield closed the week at 7.34%.

The second week started on a negative note, tracking a surge in crude oil prices amid geopolitical tensions in the Middle East and due to likely OMO sales. India’s retail inflation printed at a three-month low of 5.02% in September on the back of softer vegetable prices. However, as the week progressed, the bond market witnessed a softening in yields due to a decline in UST yields. The 10-year benchmark yield slipped and closed the week at 7.32%.

The report also includes information on CRISIL’s data and analytics platforms, including Alphatrax and Quantix, which enable clients to assess industry and company-level risks based on CRISIL’s proprietary models. CRISIL ESG Scores help benchmark companies based on their inherent ESG risk using public domain information and a proprietary framework. The company reports, which combine select financial and non-financial data, analytics from CRISIL’s proprietary risk models, and commentary on a company’s financial performance, are used by commercial banks, financial institutions, and non-banking finance companies as part of their credit/risk management process. CRISIL’s SME Gradings, used by lenders, assess the creditworthiness of SME enterprises relative to their peers leveraging CRISIL’s proprietary grading model.

Insights from CRISIL Market Intelligence and Analytics November 15, 2023.

The report also includes a privacy statement and analyst disclosure, as well as company disclosure information. CRISIL Research does not provide investment banking or merchant banking or brokerage or market-making services. The company encourages independence in research report preparation and strives to minimize conflict in the preparation of research reports through a strong governance architecture comprising of policies, procedures, and disclosures. CRISIL Research prohibits its analysts, persons reporting to analysts, and their relatives from having any financial interest in the securities or derivatives of companies that the analysts cover. CRISIL Research or its associates collectively may own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of the research report. CRISIL Research or its associates may have a financial interest in the form of holdings in the subject company mentioned in this report.