- 700 bps climb to be driven by fleet addition, new routes, direct flights to key destinations

- The share of Indian airlines in international passenger traffic originating from, terminating in, or transitioning through India is seen surging 700 basis points (bps) to ~50% by fiscal 2028 from 43% in fiscal 2024.

- The improvement would be driven by Indian airlines deploying additional aircraft and adding new routes in the international segment, as well as their inherent advantage of superior domestic connectivity compared with foreign carriers.

- The business profiles of Indian carriers will strengthen as a result of their rising share in international traffic, which is more profitable than the domestic segment.

- India’s international passenger traffic grew to around 70 million in fiscal 2024, from a low of 10 million in the pandemic-hit fiscal 2021, to surpass the pre-pandemic level. The share of Indian airlines, which was rising steadily earlier, picked up pace since the pandemic

INDIA: The share of Indian airlines in international passenger traffic originating from, terminating in, or transitioning through India is seen surging 700 basis points (bps) to ~50% by fiscal 2028 from 43% in fiscal 2024.

The improvement would be driven by Indian airlines deploying additional aircraft and adding new routes in the international segment, as well as their inherent advantage of superior domestic connectivity compared with foreign carriers.

The business profiles of Indian carriers will strengthen as a result of their rising share in international traffic, which is more profitable than the domestic segment.

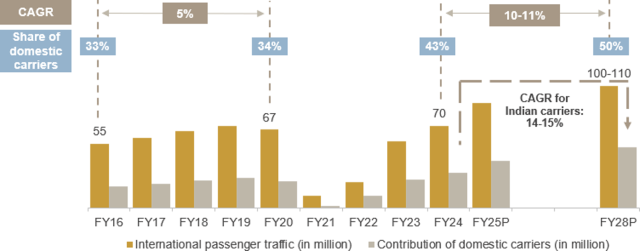

India’s international passenger traffic grew to around 70 million in fiscal 2024, from a low of 10 million in pandemic-hit fiscal 2021, to surpass the pre-pandemic level1. The share of Indian airlines, which was rising steadily earlier, picked up pace since the pandemic (see chart 1).

Says Manish Gupta, Senior Director and Deputy Chief Ratings Officer, CRISIL Ratings, “A noticeable shift in spending patterns has emerged after the pandemic, as evident in the increasing inclination of Indians towards international leisure travel. Increasing disposable incomes, easing visa requirements, growing number of airports and enhanced air travel connectivity are boosting international travel. The government’s focus on making India a hub for tourism is also expected to provide a fillip to inbound traffic. Thus, international passenger traffic is likely to clock a CAGR2 of 10-11% over the next four fiscals, against a mere 5% CAGR in the four years3 prior to the pandemic.”

Indian airlines are looking to capture a large portion of the growth in international passenger traffic as it is typically more profitable due to higher yields and has less intense competition compared with domestic routes. They have added 55 new international routes over the past 15 months, taking their tally beyond 3004. These include direct flights originating from additional cities5 to popular long-haul destinations in the United States, Europe and Australia, effectively reducing flying time and eliminating layovers.

Note: P — Projected

Source: Airports Authority of India, Directorate General of Civil Aviation, CRISIL Ratings

Indian airlines are also aiming to deploy additional aircraft on the short and medium-haul international routes and leveraging codeshare agreements with major global airlines to offer onward connectivity to passengers.

As such, Indian airlines have certain natural advantages in cornering a larger share of the country’s international traffic compared with foreign airlines. They have superior domestic connectivity than their overseas counterparts – which serve only select Indian cities – and can offer end-to-end international connectivity on a single ticket to travelers from Tier 2 and Tier 3 cities.

India’s geographic location also lends itself well to air connections between the EMEA6 and Asia Pacific regions, potentially positioning the country as a hub for international travel.

Says Ankit Kedia, Director, CRISIL Ratings, “To capitalize on the growth in international travel, Indian airlines are investing in widebody and long-range narrowbody aircraft for network expansion, adding new international routes and introducing long-haul non-stop flights to key destinations. Aided by the planned fleet addition and network expansion strategy, Indian airlines could log a CAGR of 14-15% in the international segment over the next four fiscals, taking their market share to 50%.”

- 1 67 million passengers in fiscal 2020

- 2 Compound annual growth rate

- 3 Fiscals 2016-2020

- 4 As per the 2024 summer schedule of Indian airlines

- 5 21 new city pairs covering long-haul destinations during Oct-Dec 2023 compared with Oct-Dec 2019

- 6 Europe, the Middle East and Africa